In 1978 California voters passed a constitutional amendment (also known as “Prop 8”) that allows a temporary reduction in assessed value when a property experiences a “decline-in-value.” A decline-in-value occurs when the current market value of your property is less than what the current assessed (taxable) value is under Proposition 13 as of January 1 (Lien Date), the date set by law for determining the coming year’s assessment. Decline in Value information is available online.

Decline-in-value reductions are temporary reductions reviewed annually. If your assessed value has been reduced, the value of your property will be reviewed on January 1 each year until its market value is greater than its Proposition 13 value. At that time the Proposition 13 value will be restored.

Properties adjusted due to a decline in value are exempt from the 2% annual increase limitation imposed by Proposition 13. They are reviewed and adjusted annually, and they will remain equal to or below the Proposition 13 value.

If your property assessment was reduced or changed, you will receive a “Notice of Assessment” from our office. Your property tax bill, which is mailed in October, is based on the assessed value indicated on the notice. If you believe the value indicated is a fair indication of your property’s market value as of January 1, no further action is necessary.

We accept Informal Request for Review forms for the current assessment year from July 2nd through September 15th.

FAQs and more information about Assessment Appeals are available here. Regardless of the results of that the informal review, property owners are entitled to file a formal assessment appeal application through November 30th, with the Clerk of the Board. You can contact the Clerk of the Board at (209) 468-2350 for more information.

Do you question why the assessed value of your property went up more than 2 percent since last year?

The answer can be found in the way property is assessed under Propositions 13 and 8. Generally speaking, the assessed value of your property under Proposition 13 is established when you either buy or build your property. This is called the “base year value.” The base year value increases each year by an inflation factor (California Consumer Price Index-CCPI) or 2%, whichever is less, even if the market value of the property increases at a significantly higher rate. Under Proposition 8, the annual assessment changes (both increases and decreases) according to market indicators until such time as the Proposition 13 value equals market value.

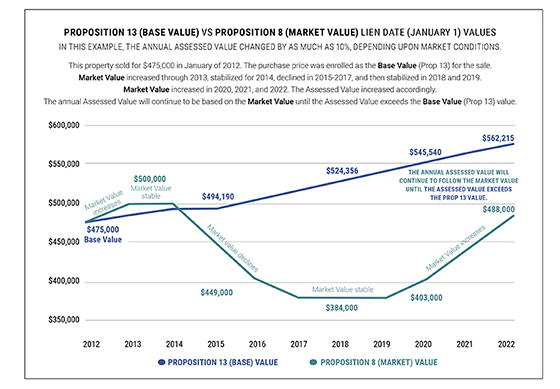

See the chart below to help understand this example:

- Year One: If you purchased your home in Year 1 for $475,000, the base year value is $475,000 (Prop 13).

- Year Two: By Year 2, the actual market value of your property had increased to $500,000; the assessed value (limited by 2% annual increases) had only increased to $494,190. So your property tax was based on $494,190 (Prop 13).

- Year Three: In Year 3, the market value of the property falls below the factored base year value, so the property is assessed at market value (Prop 8). The property is reviewed annually as mandated for the January 1 Lien Date. As long as the market value is lower than the Prop 13 assessed value, the market value will be enrolled. When property values recover in the future and the market value is once again above the factored base year value, the assessed value will be the factored base year value (Prop 13).

In the example below, the market has rebounded to $488,000 in Year 10; the factored base year value is $562,215 (Prop 13). The assessed value would be the lower of the two, which is the market value.