Ron Freitas

District Attorney

District Attorney

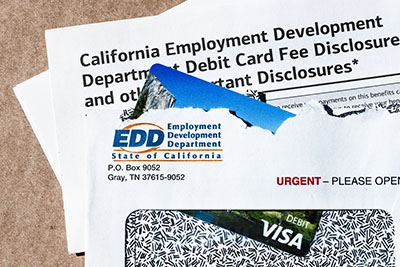

The federal government has extended Pandemic Relief through Unemployment Benefits and scammers have been using victim’s personal identifying information to fraudulently apply for and receive those benefits under the victim’s name. These benefits are reported to the IRS as taxable income and will be taxed federally. If someone applies fraudulently under your name, you may be taxed on those benefits or subject to administrative or criminal investigations for Unemployment Insurance Fraud.

Victims of Identity Theft and / or Misuse can be people, living and deceased, businesses, schools and government offices and agencies. Just because your bank or credit card company reimburses you for your financial loss, does not mean you are not a victim. It means that both you and your financial institution or school or business are both victims. Make a police report so that if and when your credit card, driver's license, mail or other document containing your personal identifying information is found, officers know how to reach you and return your property to you.

In September of 2018, a federal law was implemented which made credit freezes (also know as “security freezes”) free with the respective credit reporting agencies, Experian, Equifax and Transunion - The Federal Trade Commission’s website has a link to each credit bureau’s freeze website. The credit bureaus keep records of your accounts and payment history which credit card companies and lender’s use to assess whether you will pay your bills. If you freeze your file, the bureau’s will not provide information to lenders unless you thaw the freeze first using a special personal ID number. The bureaus cannot charge you to thaw your credit either. Unfortunately, you have to do a freeze at each of the credit reporting agencies. When you want new credit, you have to request a thaw of each credit bureau because you do not know which bureau the lender will use. Parents can create and freeze credit files for their children under the age of 16 free of charge as well.

There is a fourth smaller credit bureau called the National Consumer Telecom and Utilities Exchange which provided information to some cellphone, pay TV and Utility companies. This bureau is housed and managed by Equifax, but is its own separate entity, so you will have to apply to them for a separate freeze of your cellular, Pay TV and or Utility account.

Credit Bureaus also offer a credit lock – but these carry fees because they are not regulated by federal law.

You can also get a fraud alert – it requires credit bureaus to contact you to verify your identity when a company requests your credit file. Under the new legislation, that alert must last a year once established and unlike credit freezes, once you establish it at one bureau it is established at the other two.

San Joaquin County District Attorney Office

222 E. Weber Ave., Room 202, Stockton, CA

(209) 468-2400

Stockton Police Department

22 E. Market Street, Stockton, CA 95202

(209) 937-8377

San Joaquin County Sheriff Office

7000 Michael Canlis Blvd., French Camp, CA 95231

(209) 468-4400

For a list of all local Law Enforcement Agencies, see our RESOURCES page

For more information on Identity Theft contact the Federal Trade Commission

Information contained provided by:

Federal Trade Commission's Identity Theft Page

San Joaquin County CASE program

The Quality of Life Crimes Division handles crimes that directly affect the everyday lives of San Joaquin County residents. This Division encompasses the following units: Arson, Animal Cruelty, Agriculture Crimes, Environmental and Consumer Fraud, Public Assistance Fraud, General Insurance Fraud, Worker's Compensation Fraud and Auto Insurance Fraud, Real Estate Fraud, Elder Abuse, Auto Theft, White Collar Crime, Identity Theft, and Neighborhood District Attorneys.

Katherine Mahood

Deputy District Attorney

Message Line:

(209) 468-0659