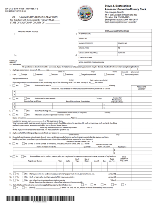

Claim for Veterans' Exemption

- Form Number: BOE-261

- Submission Deadline: Feb 15

- Topics: Assessor, Exemptions, Veterans

- Last Updated: Aug 2006

General Information

There are a number of alternatives by which a Veterans' Property Tax Exemption may be granted:

Alternative 1: The exemption is available to an eligible owner or the veteran spouse of an owner of a dwelling that is occupied as the principal place of residence for the veteran as of:

- 12:01 a.m. January 1 each year;

- the date of the veteran’s qualifying disability or compensation rating from the USDVA;

- the date residency is established at a property already owned by the qualifying claimant; or

- the date the veteran died as a result of a service connected injury or disease where the unmarried surviving spouse is the claimant.

Alternative 2: The exemption is available to an eligible owner or veteran spouse of the owner of a dwelling subject to supplemental assessment(s) resulting from a change in ownership or completion of new construction on or after January 1, provided:

- The owner or the owner’s veteran spouse occupies or intends to occupy the property as his or her principal place of residence within 90 days after the change in ownership or completion of construction, and

- The property is not already receiving the Disabled Veterans’ Exemption or another property tax exemption of greater value. If the property received an exemption of lesser value on the current roll, the difference in the amount between the two exemptions shall be applied to the supplemental assessment.

- The owner does not own other property which is currently receiving the Disabled Veterans’ Exemption.